People who wish to file a claim with their insurance company do so by contacting the claims department of their particular insurer. Then, they typically work with a claims representative who will help them file one.

A number of other professionals, such as examiners, adjusters, claims trainers, supervisors, and managers, also work in claims departments. They work together to guide policyholders through the claims process, investigate claims for legitimacy and damage extent, and eventually approve or deny claims. Claims departments are essential for the successful administering of benefits.

A claims department is the section of an insurance company that manages the settling of claims. Essential to any insurer, this department is tasked with evaluating whether or not losses are covered, determining the amount of money to be paid out for covered losses, investigating claims to make sure fraud is not occurring, and whatever else may be necessary in handling and processing claims.

What is a Claims Workflow

DexFLOW is a system that can manage paperless workflow project’s task and process providing the ability to retrieve at any time a document. In case of Claims department this could be an insured Claim request, policy information, risk history, past claims or any other document need for that insured.

Some terms used when talking about workflow are listed in Vocabulary

How things work

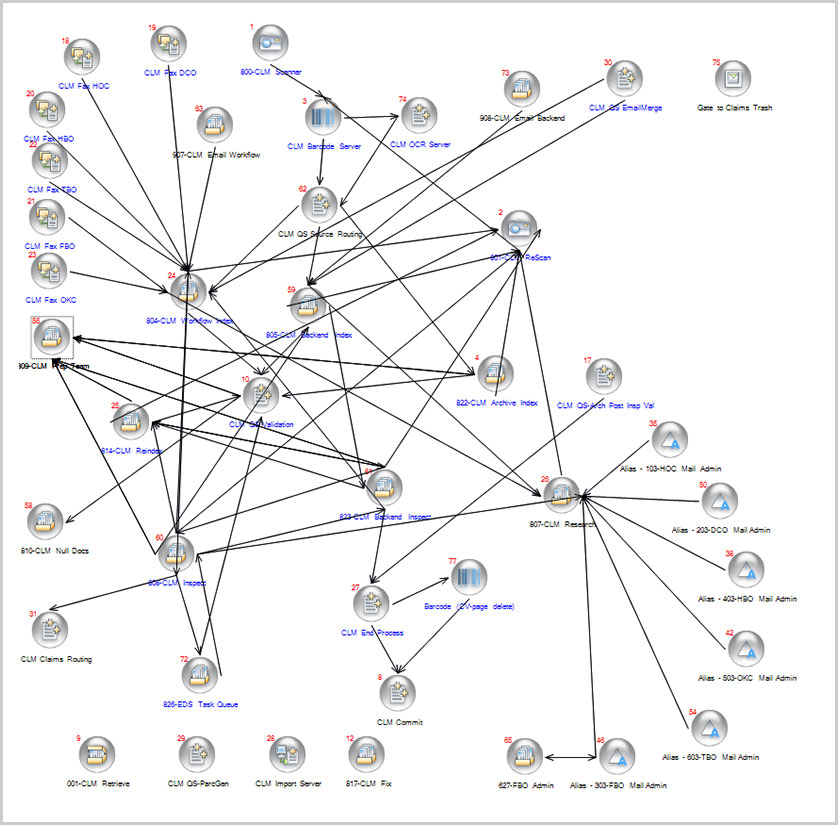

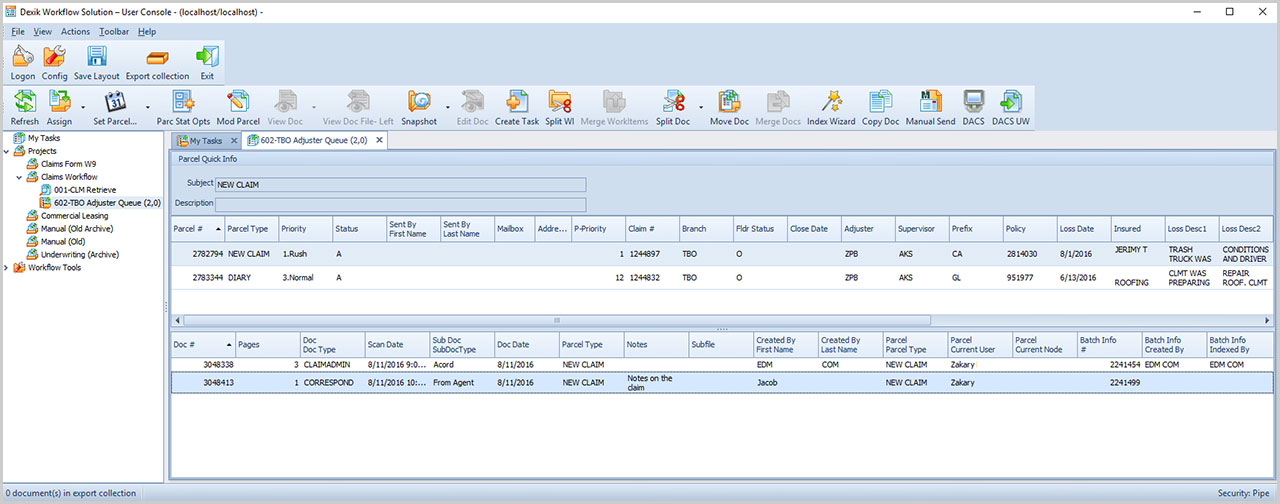

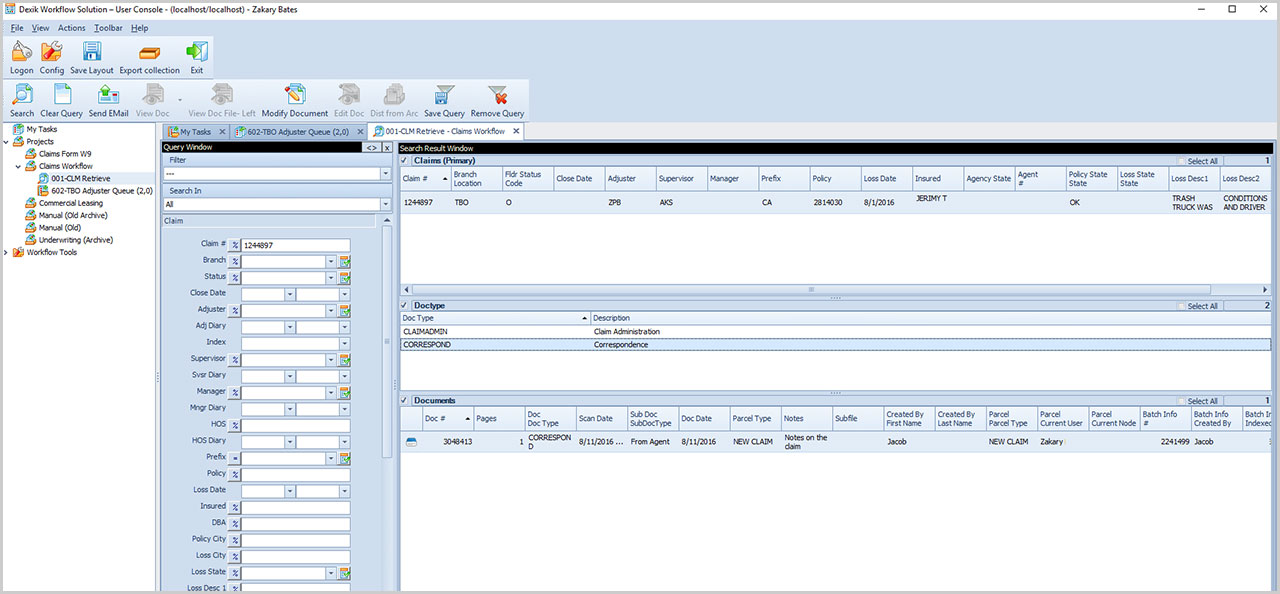

Documents for a claim can be entered in many ways for example by email capture, fax, file pickup, normal mail service and an Electronic Document Services staff personal would scan, or even use the DexFLOW office plugin to create from MS Office documents or Outlook. A parcel is created to hold the inputted documents for processing steps. Next would be indexing of the data via OCR, barcoding reading or manual. Base on rules that are configured would determine the routing of the parcel. Each company’s need and requirements are unique and the complexity for your workflow may differ.

Use Case for a New Claim Request

An insured had an accident and has contacted their agent whom filled out the claim form and emailed, faxed, mailed, web form input or other notification types to the insurance company. The email capture processes have processed the email and its attachments into an import format and send the parcel to the import and conversion processes where they are transformed into the company preferred storage format type of image.

In today’s time the personally identifiable information (PII), or sensitive personal information (SPI) being so important that the system can automatically hide, mask or block out this information base on the user’s security right when view the documents.

After processing and creating the parcel is moved to another automatic process for indexing of the claim information. Base on rules and if the document has barcodes or other type of identification information the documents are indexed to the insured and then flows to the correct adjuster for that region or district for review by the correct user. The adjuster then can investigate and process the claim as per the company’s policies and then sent to payment or denied processes for management or other processes. Once all processes are complete the parcel documents are committed into storage. As your staff need the document the retrieval process is simple and quick to view.