Insurance underwriters evaluate the risk and exposures of potential clients. They decide how much coverage the client should receive, how much they should pay for it, or whether even to accept the risk and insure them.

Underwriting involves measuring risk exposure and determining the premium that needs to be charged to insure that risk. The function of the underwriter is to protect the company's book of business from risks that they feel will make a loss and issue insurance policies at a premium that is commensurate with the exposure presented by a risk.

Each insurance company has its own set of underwriting guidelines to help the underwriter determine whether or not the company should accept the risk. The information used to evaluate the risk of an applicant for insurance will depend on the type of coverage involved. For example, in underwriting automobile coverage, an individual's driving record is critical. However, the type of automobile is actually far more critical. As part of the underwriting process for life or health insurance, medical underwriting may be used to examine the applicant's health status (other factors may be considered as well, such as age & occupation). The factors that insurers use to classify risks are generally objective, clearly related to the likely cost of providing coverage, practical to administer, consistent with applicable law, and designed to protect the long-term viability of the insurance program.

The underwriters may decline the risk or may provide a quotation in which the premiums have been loaded (including the amount needed to generate a profit, in addition to covering expenses) or in which various exclusions have been stipulated, which restrict the circumstances under which a claim would be paid. Depending on the type of insurance product (line of business), insurance companies use automated underwriting systems to encode these rules, and reduce the amount of manual work in processing quotations and policy issuance. This is especially the case for certain simpler life or personal lines (auto, homeowners) insurance. Some insurance companies, however, rely on agents to underwrite for them. This arrangement allows an insurer to operate in a market closer to its clients without having to establish a physical presence.

What is a Underwriter’s Workflow

DexFLOW is a system that can manage paperless workflow project’s task and process providing the ability to retrieve at any time a document. In case of underwriting department this could be a policy for an insured, claims, risk, past claims, other policy insure has for review or any other document need.

Some terms used when talking about workflow are listed in Vocabulary

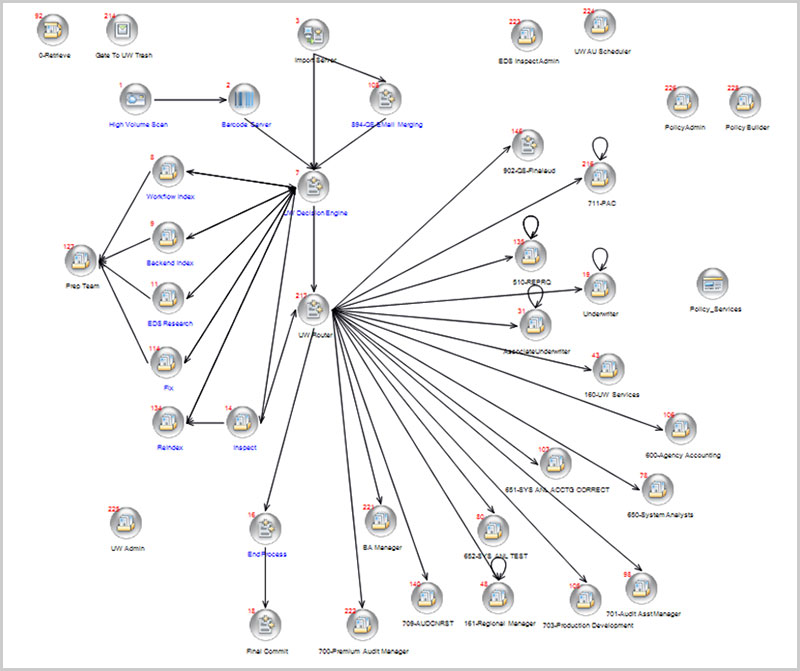

How things work

Documents for insured policy requests from agents or insured directly can be entered in many ways for example by email capture, file pickup, faxes, normal mail service were EDS staff can scan, or even use the DexFLOW office plugin to create from MS Office documents or Outlook. A parcel is created to hold the inputted documents for processing steps. Next would be indexing of the data via OCR, barcoding reading or manual. Base on rules that are configured would determine the routing of the parcel. Base on your company needs and requirements will determine the complexity of your workflow.

Use Case for a New Insured Policy Request

The Proposal form/Questionnaire duly filled in by the client/agent company with an accord form to their insurance requirement. The system imports the request and processes, indexes and routes to an underwriter to review the application/proposal form thoroughly, asked pertinent questions related to the requirement, project, proposed insured and establish information of the client/company/projects. Identify various risk factors on the specific location, or of the project to be insured, property to be insured and the probability of claims. If the proposed insured is qualified, compute the premium according to the tariff premium, company rates and/or management given rates.

In today’s time the personally identifiable information (PII), or sensitive personal information (SPI) being so important that the system can automatically hide, mask or block out this information base on the user’s security right when view the documents.

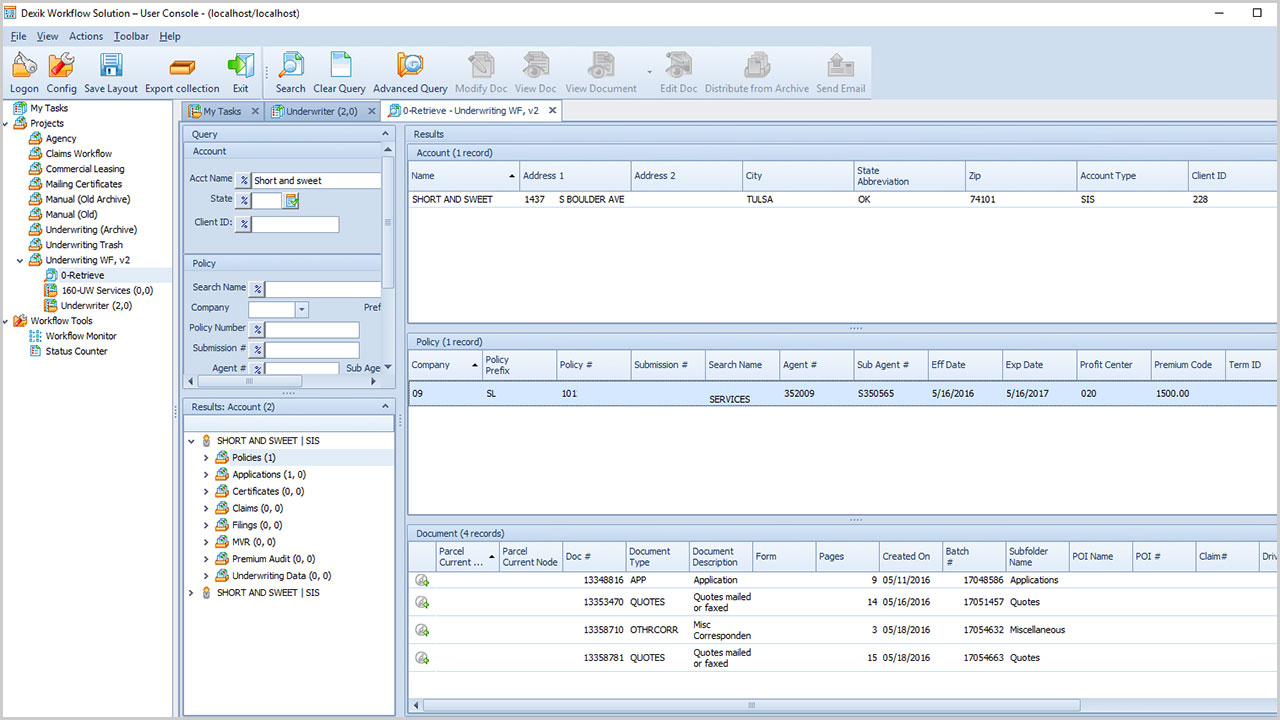

After processing the parcel is review by the correct user and then committed into storage. As your staff need the document the retrieval process is simple and quick to view.

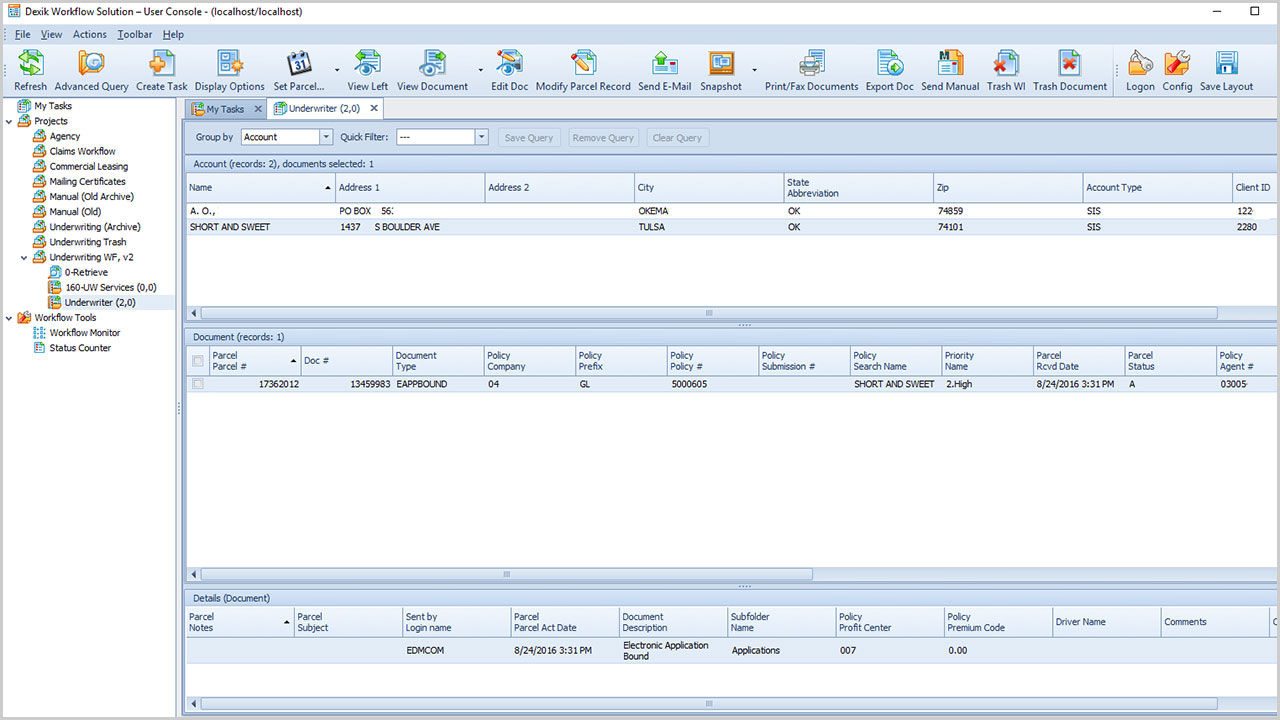

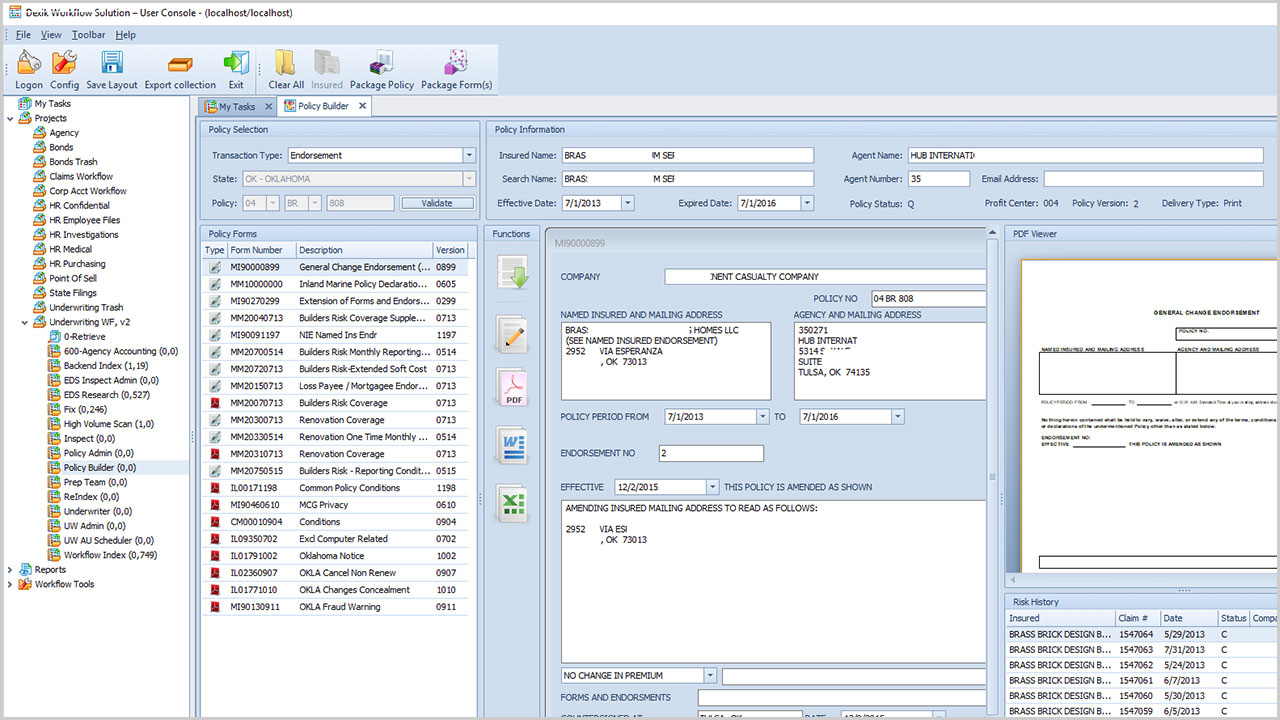

Example of a policy request in an underwriter, policy builder and retrieve nodes:

Underwriter

Policy Builder:

Retrieve: